Is the AI Bubble Real?

It's real. And it's spectacular.

Artificial intelligence is here to stay - we have said this time and again, and it remains true. It is not a fad like JPEGs of apes, or Decentraland, or the wider metaverse. It will become a huge facet of our lives that goes much further than incredible videos of cats firing shotguns in residential neighborhoods.

But there’s also a bubble when it comes to AI. Money has been pouring into the technology and the infrastructure behind it faster than a disgraced politician’s attempt to kill more grandmas in NYC. AI and the infrastructure that enables it certainly requires a lot of capital, but the returns on said capital have not materialized, and there is no game plan to recoup that money as of yet. However, if anyone who has borrowed money is aware, lenders typically want their money back - and then some. Without a black swan event that suddenly makes AI profitable within existing bounds, it is very likely that the existing AI bubble will burst.

Money Is Just the Latest Concern

We’ve looked at concerns regarding AI before on the newsletter. The primary one we have highlighted is the environmental impact of the technology. It’s hard to understate the effect the infrastructure required to utilize AI will have on our power grid and water sources.

The latest research has a potential roadmap to lower emissions and water usage, but in the real world, net-zero sustainability for the technology is very likely out of reach. And the things that can be done to reduce emissions, like placing data centers in places where water is plentiful and environmental factors make it easier to cool them, have already been preempted by massive data centers already being built in places like Nevada, Georgia, and Arizona.

And there is a commonality here with the financial aspect of the bubble we are in: critics of the “Hey, don’t further destroy our environment for this” movement say that AI will figure out a way to be more sustainable on its own. This newsletter does not subscribe to the “I’ll gladly pay you Tuesday for a hamburger today,” type of scenario planning for environmental mitigation, and it certainly does not subscribe to it for AI financing.

How Will Lenders Recoup Their Money?

Lenders are tripping over themselves to provide debt for the construction of AI data centers. And we’re not talking a billion here or a billion there. We’re starting our numbers with a T now.

Morgan Stanley believes that AI-related spending will reach $3 trillion by 2028. The revenues generated by AI software? They’re a bit further back at $1.1 trillion. These are not small amounts of money - we are talking about over 5% of the entire US annual GDP in the gap between expenditure and revenue.

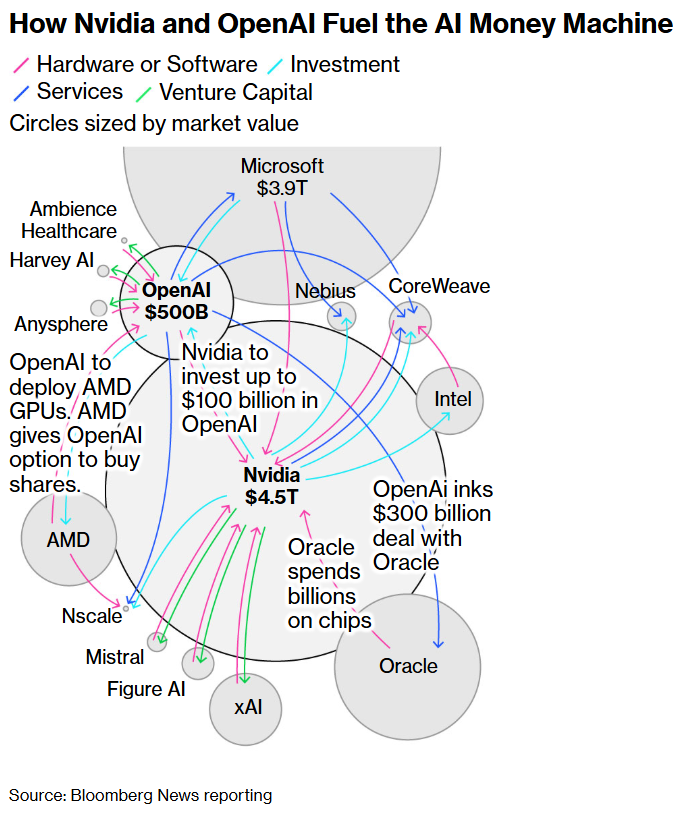

Then there’s the problem of circularity. OpenAI has been signing deals with chipmakers in which the chipmaker gives them money and then OpenAI uses this money to ostensibly buy that firm’s chips. The mere existence of circular deals isn’t new, nor is it a concern by itself. What’s concerning is the scale of them.

Circular deals like this aren’t without precedent, even at this scale. But the most recent and relevant example is not a fond one. In the dot-com boom and bust at the dawn of the millennium, telcos raced to lay fiber optic cable and other infrastructure to take advantage of this newfangled thing called the world wide web (thanks Al Gore.) The information superhighway needed, well, a highway of cables to be able to connect everybody. Telecom companies would then lend or lease their equipment to internet service providers at no cost to get them to use their equipment - essentially giving them capital to spend back with their own company.

The scale was massive, as was the crash that followed. When private lending runs out and interest rates increase (two distinct possibilities in the existing macroeconomic environment, with inflation rearing its ugly head again, which is refocusing attention on the ongoing affordability crisis in the States), these circular deals fall apart quite quickly.

And it won’t be the private lenders and tech companies holding the bag by themselves. The bond issuances hitting the larger market mean that consumer-facing funds like Invesco and BlackRock, as well as state pension plans from places like PA and NY, are exposed. This newsletter keeps coming back to scale: this is too much money for the pain to be isolated simply to those causing it.

We All Know What the Backstop Is

Matt, you ignorant slut, you might be saying, with this much money at stake and so much money to be made, companies like OpenAI will certainly be good stewards of it and ensure that they are successful - they’ve learned from 2008!

The final part of that sentence is true, given OpenAI CFO Sarah Friar’s words about financing chips for companies like hers and how the industry needs a federal guarantee for financing of chips:

OpenAI rushed to do damage control, but Friar’s words are quite clear and not taken out of context. They are even clarified by the moderator! Friar’s point was not “muddied,” as she contended, by the use of the word “backstop,” but rather extremely coherent. The fact that Sam Altman is getting defensive when asked about how OpenAI will be funding these investments does not exactly engender confidence, either.

But OpenAI’s approach to wild spending as a massive corporation in America, assuming that taxpayer monies can bail them out if they fail, isn’t exactly a crazy idea. While we all remember TARP in 2008, the history of America is one steeped in public funds bailing out private business.

We can have a debate about the efficacy and structure of these bailouts (this newsletter, for one, feels that industries like commercial aviation are so critical to America’s economic hegemony that it should be protected in some way from black swan events), but the fact remains that thinking like Friar’s absolutely leads to great moral hazard in the way of financing and growth of AI infrastructure. And given the history of bailouts in this country (despite Paul Volcker’s commandment “Thou shall not gamble with the public’s money,”) it would not be a stretch to believe that Friar’s approach to federal backstops is not unique in this arena.

So AI is Going to Crash and Go Away?

Hardly. As we’ve said ad nauseam on this newsletter and LinkedIn, artificial intelligence is not only here to stay, but has been here for decades behind the scenes. But the current scaling of investment in the technology and its infrastructure is as unsustainable as AI’s environmental impact.

We talked about the circular financing aspect of the dot-com bubble with telcos and how it contributed to a large crash in 2000 and 2001. The parallels don’t stop with this unique financing approach, however. Because even though the dot-com bubble wasn’t made to last, the technology underlying it was. The internet was a nascent tool for consumers, and it has utterly transformed the way we live and work. The dot-com bubble burst didn’t stop that.

And all of those fiber optic cables that were laid as “dark fiber” in anticipation of a connected world? They’re massively useful today and, in a twist of irony only an incredible novelist could dream up, actually power the connectivity of some massive data centers today. The belief that we needed this infrastructure was correct - the capitalistic approach to do it at an ungodly speed and the pressure for near-term returns meant it was done at a scale that required a bit of a reset via the dot-com boom and bust.

And AI is looking very similar, from the vantage of this newsletter. These data centers will be useful, but the idea that we need them at the speed and scale requiring a handful of companies and private debt creators to pour trillions of dollars into them in a matter of years (with a potential federal backstop fueling too much speculation) is where the unacceptable risk lies. Extremely fundamental questions like “How are we going to power these data centers?” and “Who on the consumer side is going to pay enough money at a price point required for these companies to stay solvent?” remain unanswered, but the money continues to flow.

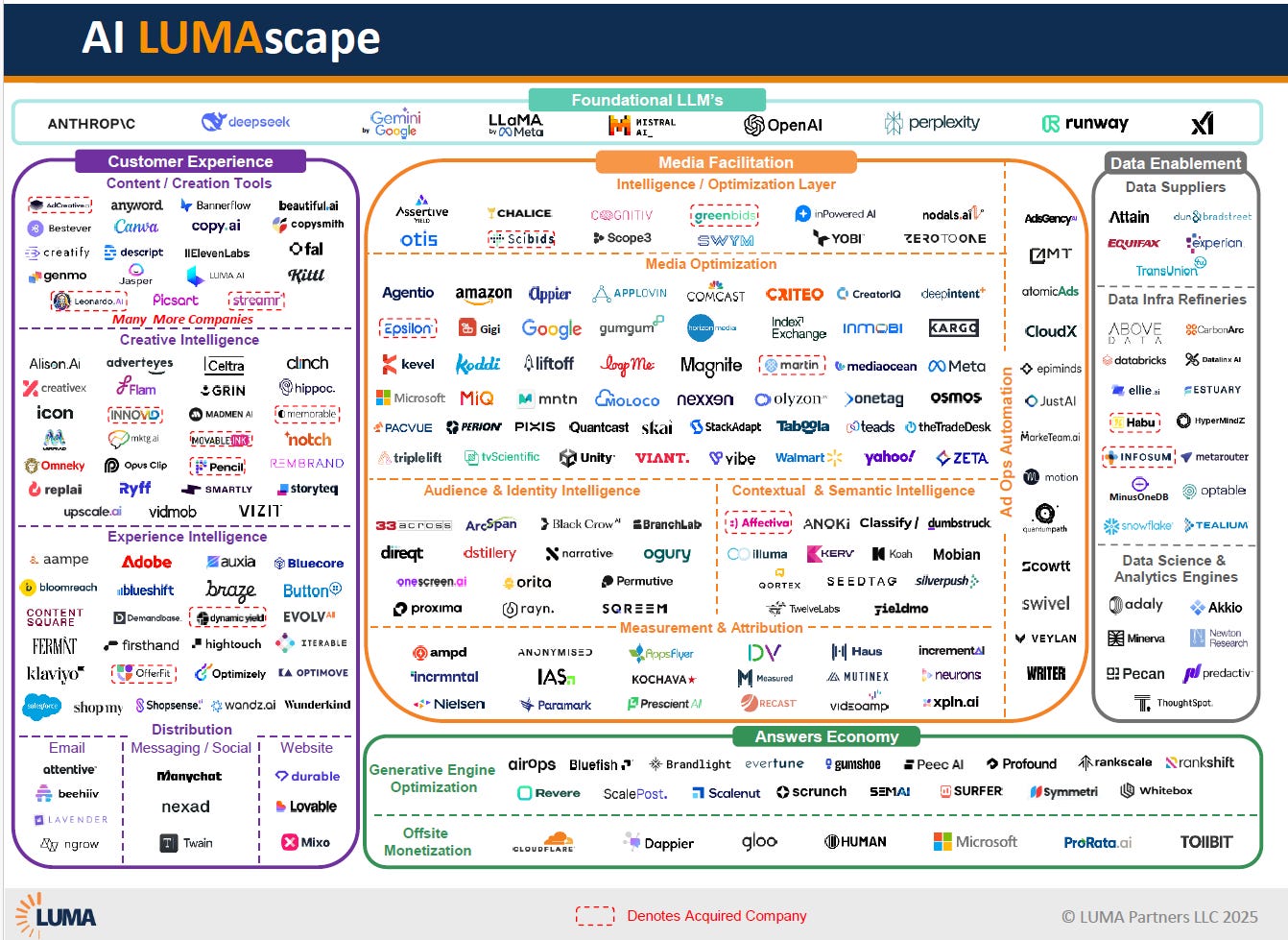

This isn’t the prediction post for this year, but some amateur tasseography tells us that the AI space is crowded, it’s expensive at large scale, it’s unproven in terms of efficiency gains promised, and it's propped up with a ton of debt with no clear plan of repayment. That is an excellent recipe for a bubble, and it is this newsletter’s opinion that we are in one.

What is likely is that the bubble will burst in the next few years (that’s what bubbles do.) The industry will need to consolidate, pick up the pieces from the bankruptcy and job losses, and - like a Phoenix rising from Arizona - a few surviving players will reap the benefits of a post-bubble AI world.

Long term, this will be a stumbling block in the story of artificial intelligence’s impact on humanity. In the short term, however, there’s potential for a bumpy ride as the amount of money at stake - and the complexity with which it is being deployed - raises the temperature without a cooling mechanism in place to keep things in control.

Grab Bag Sections

WTF Columbia: My wife and I met at Columbia as doe-eyed undergrads and this past weekend we had a chance to walk by campus on the way to a housewarming party in the neighborhood. Of course, we couldn’t walk through campus because the university has illegally closed College Walk to the public and those without valid university IDs. But that is a matter for another day.

What struck my wife and I was the turnover of stores, but this is not unique when you only visit a neighborhood every five years or so. What was particularly jarring was that the new storefronts were high-end shops and restaurants that I and many of my friends would never have been able to afford when we were attending the school.

An affordable pizza shop replaced by Lululemon. A half-decent Chinese restaurant replaced by Shake Shake. A dive bar that was lenient on IDs replaced by Sweetgreen. I would ask “Who could possibly afford this?” but the sad reality is that private university is becoming so expensive that the only people who can afford to attend are either the moneyed classes, or those with cash on hand because they’re mired in debt.

The commercial offerings of Broadway and 116th weren’t heralding in a new era of increasingly wealthy undergrads - they were catching up to demographic shifts. We talked about the AI bubble in this post, but another one to keep an eye on is the private university system.

Album of the Week: If you don’t yet have a crush on Olivia Dean, just give it time. This fall she released her second studio album The Art of Loving and has had what feels like a meteoric rise on the global stage. The reality is she has been well-known in the UK for a minute and she is claiming a well-earned spot in the cultural zeitgeist.

There are very few skips on this album, and the lyrics read like a diary into Dean’s life - both the ups and the downs. They’re raw and emtional, and Dean herself approached this album as one of vulnerability. The product is excellent because of it.

Standout track “Man I Need” is one you could leave on repeat for a week and still not get sick of it. Her performance of it on SNL showcases Dean’s charm - in many reviews of the album you will find the word “playful,” and it is spot on. Despite this being a sophomore album, Dean has the presence of someone simply having fun - the leg kicks, the hair flips. She’s performing art, not a commercial song - this is not something every artist can say.

Do yourself a favor and give Dean a spin (or, if you must, a smart speaker stream) as you prep the turkey this week and show a little gratitude that there’s still fresh art to enjoy that is yet to be sullied by the commercial music industry.

Quote of the Week: “One of the biggest mistakes you can make is to think that ‘overpriced’ and ‘going down tomorrow’ are synonymous. Markets that are overpriced often keep going.” - Howard Marks

AI Usage in This Post

There was a decent amount of AI usage in this post. One of the main ones was using ChatGPT’s deep research to give me a quick rundown of the circular financing between OpenAI and Nvidia (the output can be found here.) I also made good use of the new Gemini tool in Chrome to summarize some articles for me.

See you next post!