How Worried Should Employees Be About M&A In the Ad Industry?

Employees feel unsettled about the M&A spree in adworld - should they?

Three things are certainties in late-stage capitalism: death, taxes, and M&A in an effort for continued growth in mature markets to appease shareholders. Advertising is a mature market - John Wanamaker (oft-considered one of the founding fathers of marketing as we know it) opened his first store in 1861. Since his famous adage that half of his money is wasted in marketing - he was just unsure of which half - the industry has evolved into the absolute force it is today.

Inventions like television and the internet have catapulted the industry into a $1 trillion+ inescapable beast in modern capitalist life. In an industry this mature, the growth opportunities are few and far between. We’ve seen consolidation via mergers and acquisitions thanks to Martin Sorell’s Wire and Plastics Product holding company model; that train has more or less reached the end of the line. The final boss at the end of this game is the M&A activity we’re now seeing: data companies and the holdcos themselves.

Who Should Be Keeping an Eye on Consolidation?

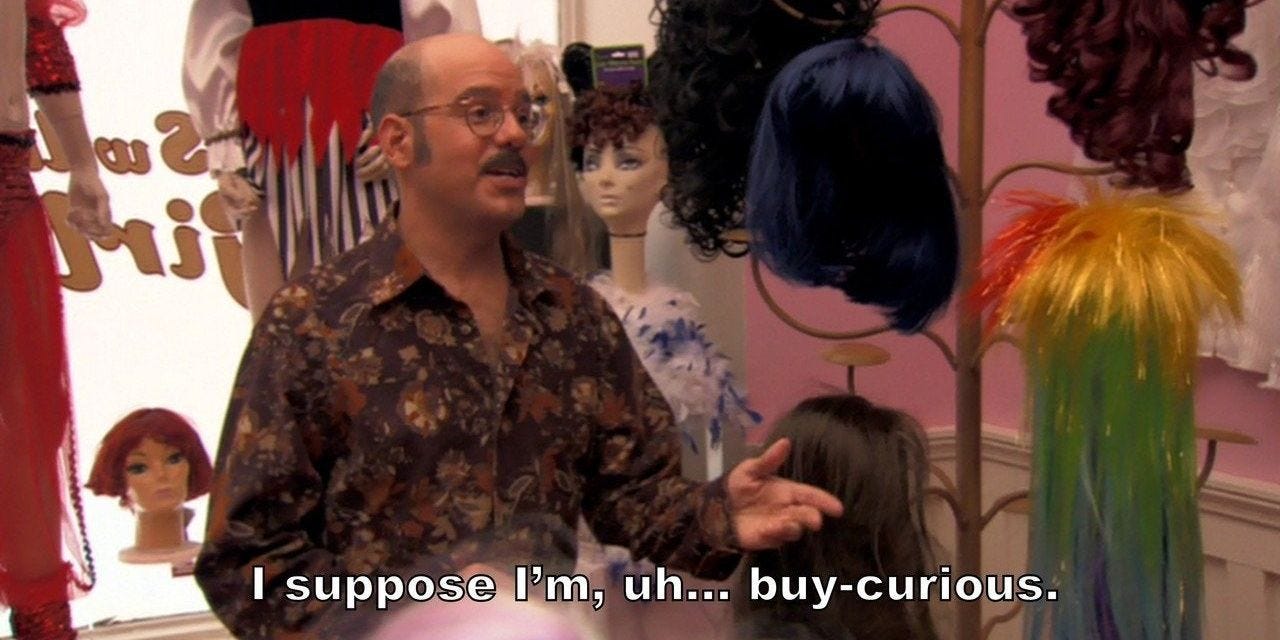

Recently Adweek had a piece about the rank of file of various agencies getting worried about all of the M&A in the space. Granted, there was a crucial caveat here in that most of the respondents were from non-holding company agencies. But not to be outdone by their indie brothers and sisters, the trades made it clear that holdco employees also don’t love where they’re at these days.

Regardless, M&A can seem scary to employees of all levels. Consolidation very rarely leads to short-term job openings and instead translates into the ills of the system agency employees deal with on a quarterly basis: hiring freezes, promo freezes, slashing of “non-essential” spending (i.e. initiatives that tend to disproportionately benefit junior employees.) So a dose of fear isn’t exactly unwarranted.

But the consolidation discussed in the intro - that has been a constant in the background as long as just about any of us have been in the industry. Some years it feels hot, others feel cooler - but it is a constant. That said, there are a few groups of folks who should be paying closer attention than others.

Indies Doing Good Work

If you find yourself at an independent shop that seems to have a hot hand with new business and continues to pump out award-winning work, you most certainly have caught the eye of holdco procurement teams.

If you like the indie experience and your shop is churning out good work and winning awards and getting press, you want to keep an eye on this space, because as much as independence is valuable, you can’t put a price on it (like you can an acquisition.)

There’s also the other (albeit much rarer) direction: decouple yourself from a holdco and go “independent.” The quotes here are for very good reason: R/GA’s recent conscious uncoupling from Interpublic Group bought the agency their independence back from the evil, evil holding companies only to have to answer to…a private equity company. It made a splash at the time, but in reality all R/GA did was make a switch from holdco oversight to PE oversight - time will tell which feels more onerous.

Omnicom and IPG Employees

While the merger is anything but assured (both history and the current administration’s schizophrenic decision making leaves a lot unsettled here), employees of these two holdcos do have some right to worry. The marriage of these two companies will absolutely lead to “streamlined processes,” which we all know is corporate speak for layoffs.

So much so that the other holding companies have publicly said they’ll go fishing where the potentially laid-off fish are. Any particular employee’s termination is certainly not a forgone conclusion, but keeping your resume and LinkedIn updated wouldn’t be the worst idea in the world for folks who find themselves party to John Wren’s and Philippe Krakowsky’s forthcoming nuptials.

People at Data/Identity Companies

A lot of the A in M&A is happening in the data space. Holding companies want identity solutions like Epsilon and Acxiom in their stables, and they also want data collectors with unique sets to tout exclusive offerings in new business pitches to potential clients.

Being bought by a holdco isn’t necessarily a concern here - they will desperately need SMEs in the space these companies operate within, as well as expertise on how to mine and activate the data that was so sought after. In fact, it might be time to try to use that as leverage in the case that you do enter the industry via acquisition.

The Real Concern

But, dear reader, this can all feel like a red herring compared to the larger forces at work when it comes to working at agencies in Mark’s, John’s, Arthur’s, and Phillippe’s world.

We’ve touched on this before, but the vibrant cultures from agency to agency are starting to disappear thanks to the myopic focus on shareholder value that public companies adhere to. And an increase in industry consolidation will only further this worrying trend.

With the consolidation we’ve seen comes centralized functions. At some point it becomes less efficient to have so many agencies under a single holdco umbrella. In order to make a quarterly or annual number holdcos will begin to liquidate smaller or flagging agencies into other larger, healthier ones under their purview. It’s already been happening the past few years.

Taken to its extreme, this dystopic future sees people simply working for larger holdcos, not agencies within a holdco. In the most generous reading of this worst-case-scenario, it would be a couple of large, specialized agencies under a holdco - akin to departments under a major single-brand conglomerate.

Is this set in stone? Certainly not. But the chances of it are not only non-zero, but probably pretty decent from this newsletter’s reading the metaphorical tea leaves. The less certain variable is the time this would take to get there vs. it actually occurring. We’re talking many years if not decades for this to become standard operating procedure.

This is not only an ad industry problem - this newsletter is just closest to that space and it’s been grabbing headlines recently. The M&A trend tends to permeate any vertical with slowed growth thanks to maturity of the market. This is more a symptom of late-stage capitalism in general than it is a chronic disease of marketing specifically. That’s a small consolation for those caught up in the leviathan’s tentacles, but the first step towards a solution is admitting you have a problem.

Grab Bag Section

WTF Weekly Newsletters: If you’re a keen reader of TDNBW, you’ll notice that the frequency of posts has been declining of late. This is due to a combination of things, some I thought were short-term and others proving to have more lasting power.

That said, the weekly cadence I started out with is becoming unsustainable. Work is picking up and the kids are somehow taking even longer to go to bed each night. Post-toddler bedtime is the right time for writing this newsletter and that window shrinks every month.

So it’s time to “set expectations” (in the parlance of client services) when it comes to cadence: we’re officially moving to a bi-weekly (every other week, for you pedantic folks) format. This will ease the self-imposed pressure to get something out in a rush, preserve product quality, and also keep this fun (the second this newsletter begins to feel like a chore, I’m out.)

So kindly adjust your schedules and keep an eye out for the bi-monthly (that’s twice a month for you pedants) issuance.

Yours in being overwhelmed,

This Does Not Bode Well

Album of the Week

If you’re unfortunate enough to follow me on Instagram, you were alerted recently that I have turned my handle into a Clipse fan account. I know we’re all counting down to July 11 when Let God Sort ‘Em Out drops, heralding the return of the Thornton brothers.

Their debut album Lord Willin was phenomenal and “Grindin” spelled trouble for the structural integrity of cafeteria tables in middle and high schools across the country. Then - as they are wont to do - the label began screwing things up. It would be four years between the group’s debut and sophomore studio albums, but they did finally drop Hell Hath No Fury to broad critical acclaim, even if commercial success remained elusive.

Both singles are excellent - “Mr. Me Too” and “Wamp Wamp (What It Do)” with a solid feature from Slim Thug. The best track on the album is the insanely catchy “Keys Open Doors” (listen to it on a Monday and you’ll end your work week with the chorus in your head.) The album is bookended by quality tracks as well - “We Got It For Cheap” on the intro and “Nightmares” on the outro.

In classic Clipse fashion, their upcoming album also has label drama - this time when the suits over at Def Jam demanded the removal of a Kendrick Lamar feature. Clipse aren’t ones to back down and after a seven-figure buyout they’re over at Roc Nation and now free from the Universal Music Group executives afraid of Drake’s lawyers.

In any event, give Hell Hath No Fury a listen this week - even if most of the streaming money will go to Sony.

Quote of the Week: “Individualism is a formidable lie.” - René Girard

See you next week!