Don’t Discount the Work

Professional services agencies are racing to the bottom with fees, but in doing so they are playing with fire.

We touched on the idea of too much work recently, and the problem only grows as the growth at all cost mindset further cements itself into global capitalism (and they say America has no culture.) While there is not a solve, per se, the way to dredge oneself out of this to at least get to treading water is through impeccable time and project management.

But we take that for granted. You could have the best time management system for yourself setup and it still might not be enough. Thanks to a somewhat complex approach to scoping and fees, agency management is making it harder and harder to stay on top of one’s work regardless of how efficient they may be. While solving for personal project management, we also need to keep our leaders accountable for decisions that drive overwork and underscoping.

Doesn’t Project Management Keep Workloads Efficient?

Yes, it does. That is, if you’re lucky enough to be on a team staffed with PMs.

Project management is one of the most overlooked aspects of agency life - some see them as mere deadline police who constantly check in on projects and not much else. Others see them as bloat on an account’s books, doing a job that a team with competent management and leadership should be able to do themselves (and thus hurting margins without adding the requisite value.)

The reality is that both can be true. Mediocre PMs are essentially deadline cops. If client-agency relationships ran like they are supposed to, project management might actually be somewhat of a redundant capability within a large team. But good PMs can drive the kind of efficiency that accounts need to not merely provide client services, but to grow into an actual partnership between client and agency. I’ve been lucky enough to be on accounts like this, and let me tell you, dear reader, it is like night and day when you work on an account that is mostly - if not purely - transactional. When you work on one that is a true collaboration, you’ll know.

If you’re lucky enough to have solid PMs on your account, first you need to go light a candle at church or say some prayers facing towards Mecca because you are very lucky. Next, you need to collaborate with them and make sure they feel they have the space and authority to get shit done so that if the finance department comes knocking you can help to justify their place as a cost center on the account in an environment in which they are being removed from scopes for cost savings.

A PM Shortage is a Canary in the Coal Mine

A lack of PMs on an account is a symptom of a larger disease currently afoot in the industry: a race to the bottom on fees to get clients in the door.

This is not new, but has been exacerbated of late. One idea gaining momentum when it comes to scoping is to get a smaller client or project into the doors of the agency for cheap and turn it into a larger account through either an upsell that makes sense in a year down the road or by showing their parent company that the agency has the chops for more business. While conglomeration may have taken a hit during the Reagan years, there’s a new form of it in the tech space and PE plays a role as holdcos of multiple companies in related verticals, which has not gone unnoticed in the professional services sector.

In order to do this, the scope needs to be small - too small - with the hope that before burnout turns over the whole team the account has grown in a way that it can be properly staffed while hitting reasonable margin goals and growing into what the account should have been at the outset. The business model - albeit a risky one - makes sense if and when it works. And while it may be a novel business model to agencies, it’s not, in and of itself, a novel business model.

Agency HoldCos Are Not PE Firms

The problem with this model is that it doesn’t make a lot of money in the short tem. In some extreme cases, it actually loses an agency money. And this is where the private equity influence is becoming apparent in holdco agencies: some try this strategy across a couple of accounts with the hopes that one account pops into a much larger AOR relationship to help make up for losses in the others.

This is a game PE (specifically, VC) can play - invest in or acquire a bunch of companies absolutely hemorrhaging cash with the hopes that they might turn into the next Facebook or Uber or AirBnB and you can more than cover your losses on the losers. But these financial companies have financial games they can play that holdcos can’t, namely debt loading among the companies in their portfolio. Holdcos can’t pile an account with debt - they are giving up margin when underscoping an account, not playing with other people’s money and relying on a last ditch bankruptcy to clear a debt load (just ask Red Lobster.)

The “debt” that holdco agencies are playing with are FTE allocations. And unlike paper debt, FTEs can walk away (and clients hate high attrition or large turnover at an agency; like most businesses, they like stability.) Sure, you can double-scope someone on two accounts and if they stick around the margins are great, but (outside of the unethical nature of this) it’s not sustainable. In extreme cases this can also lead to bleeding some larger, established accounts like a stuck pig for their margin or people (or both!) to help out the flagging accounts. This just spreads the misery for a potential gain on a single, underperforming account for guaranteed degradation on an established one.

To Be Used Sparingly but not In Case of Emergency

This approach to client acquisition and scoping is not the norm by any stretch of the imagination, but this newsletter has seen it pop up across multiple agencies in multiple holdcos. Again, it’s not a guaranteed losing business strategy, but like a pitcher who over-relies on a funky slider, when attempted too many times they’re going to get lit up.

Even assuming it works more often than not (and from this author’s experience, it does not), the strategy itself is one that invites chaos and burnout. This approach to scoping and new client acquisition has a place and has a time, but that place is an already-healthy agency and that time is rarely.

If your agency has struggled to grow for the past few years and you see this practice coming down the pike more often, it might be time to jump ship. Because this strategy is essentially digging a hole you hope you can eventually get out of, but if you’re digging that hole already below sea level you’re in trouble.

If your agency is doing well, but you feel your work/life balance isn’t where you want it and you see this tactic pop up in BD scopes more often than feels responsible, it also might be a red flag. We already live in a society where work is prioritized far too often and this strategy is a sure sign of more hours hunched over your laptop in the near future.

The larger problem is that this strategy has been employed - with varying degrees of success - in enough places that it is a non-zero threat in pitches. No agency wants to lose a potential client over fees, but they also need to be compensated for their work. And good work deserves good compensation. It’s a no-win situation for agency leaders and one that may need a reckoning within larger industry circles.

This reckoning could come through the recent discussion around the 4 day work week. Debates around productivity in our current 40-hour week have been gaining (legitimate) steam, and it follows that the idea that agencies can get business by just giving a client a heavily discounted taste because their product is that good may very well be antithetical to solid, productive work. Besides, that’s what the pitch - and already insanely expensive endeavor for agencies - is for. If we want to work insane hours because there’s too much work to go around, we should all go for a spot in PE (and at least get some carry.)

Grab Bag Sections

WTF Boston Haters: We’re loud, we’re obnoxious, we probably have more titles than your town and we’re going to let you know it. We know our teams do shady shit, but we’re winners and your team didn’t do it - not because of some moral high ground but because they didn’t think of it first. That’s right, we’re Boston sports fans.

So you can see why people hate us - who likes a successful group of people who constantly act like the victim? But this year’s NBA seaon, dear reader, proves that the Boston haters actually fuel it.

As the Celtics forcefully tore through the NBA this season on their way to collect their record-breaking 18th banner to hang in the Garden all Boston fans heard during the playoffs was how easy a road they had it through the East. How a reckoning with the West was going to be so painful - but oh so enjoyable for non-Boston fans - in the Finals.

And we gave Dallas a game because we felt bad that their star player is an anti-Semitic flat earther and their other star player only plays offense. Plus, we wanted to win in Boston. Because this team was that good. So the hate, the vitriol, the doubting - it only feeds the victimization of Boston sports fans. If they really wanted to get under our skin they would have said what a dominant team we were and anything less than a Finals sweep would be a disappointment. But they didn’t, because their hatred of us is stronger than our self-victimization and the cycle will continue onto banner 19 unless the haters realize how wrong they are.

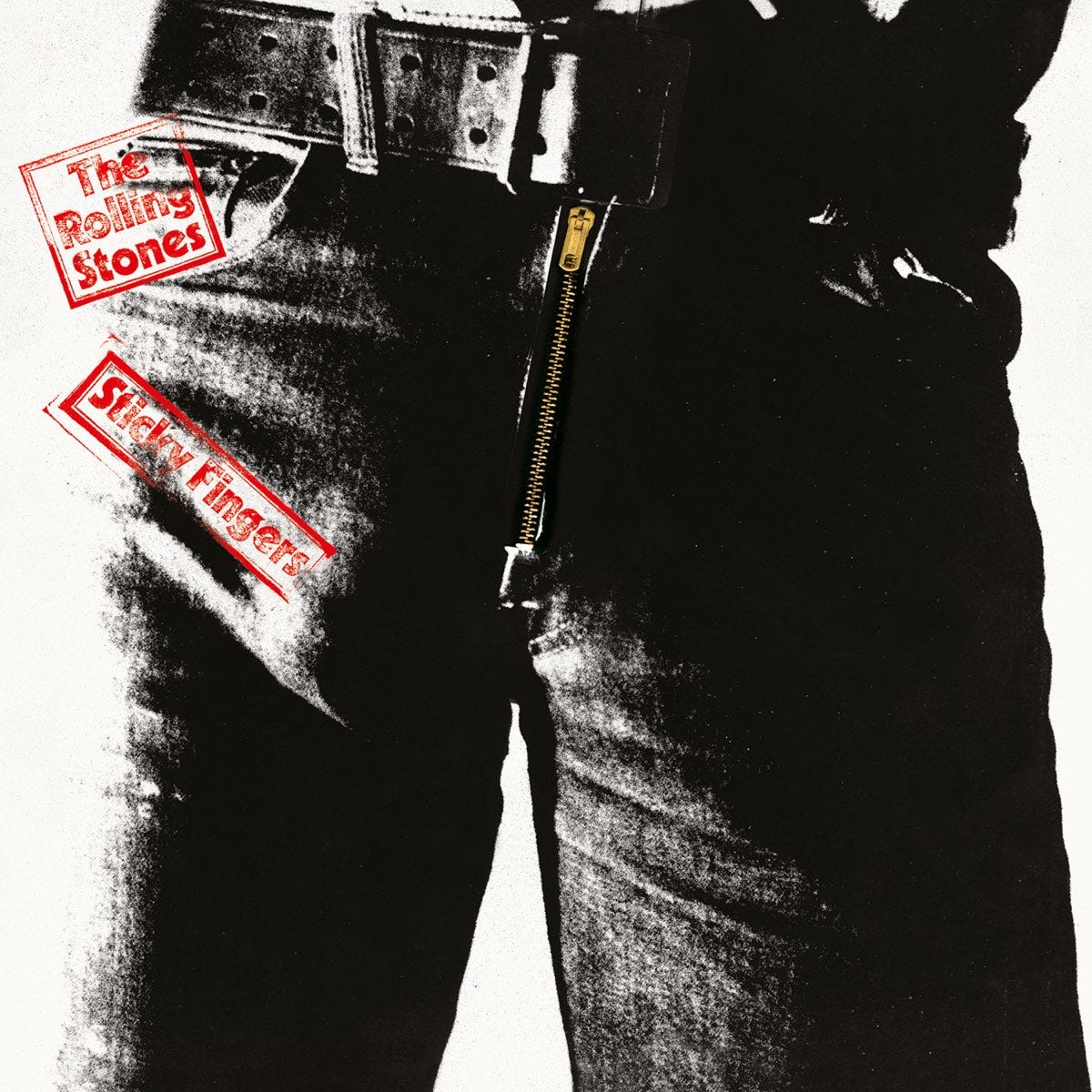

Album of the Week: We reviewed Goat’s Head Soup a few months back in a nod to the Rolling Stones’s approach to slower rock (and more subtle sexuality.) This week we’ll look at Sticky Fingers as the band re-focuses on jazz and intros the album with a song so offensive Jagger won’t even play it live anymore.

To get it out of the way: “Brown Sugar” is a great song that is wildly problematic, and we’ll leave it at that. “Wild Horses” is my favorite song on the album, but “Sway” and “Can’t You Hear Me Knocking” are not to be missed. The album is the Stones unfettered from their relationship with Decco with an attitude of “screw you” to their hated ex-manager Allen Klein. This combination of talent and toxicity led to one of the best Stones albums, with the return to rock and roll’s roots in jazz and soul shining through.

Quote of the Week: “Just do what you do best.” - Red Auerbach

See you next week!